tax loss harvesting limit

You may work with a client on tax-loss harvesting when youre trying to reduce the amount of capital gains taxes your client will owe. 3000 per year for individual filers or married couples filing jointly or 1500 per person per year if you are married filing separately.

Tax Loss Harvesting Definition Example How It Works

Unfortunately there are some limits and rules to abide by.

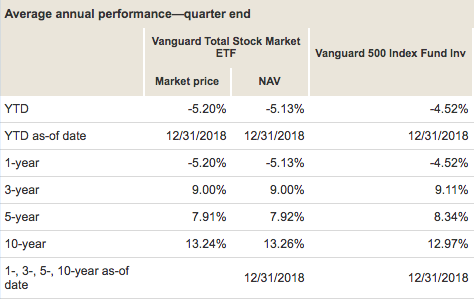

. Ugly market events like in 07 to 09 can be an opportunity. And if you are wondering what long capital term gains are well it the returns you make by selling your equity investments held for more than 12 months. Tax-loss harvesting is the selling of securities at a loss in order to offset the amount of capital gains tax due on other investments.

There is an annual limit of 3000 on tax-loss harvesting so the investor with a capital loss of 5000 can use. Unused losses can be carried forward indefinitely. Whats more losses can be used to limit tax exposure from noninvestment income as well as to offset investment gains.

Taxpayers can often use tax-loss harvesting to lower their tax burden by selling their investments at a loss. Generally those losses can then offset any capital gains from selling securities. And for those with larger amounts of capital Schwabs tax-loss harvesting kicks in for clients who have invested assets of 50000 or more.

Tax-loss harvesting is when you sell investments at a loss in order to reduce your tax liability. Tax-loss harvesting is valuable only in taxable accounts not special tax-advantaged accounts such as IRAs and 401ks where capital gains arent taxed annually or. Lets take a look at how this works.

Use the power of tax-loss carryforwards. Is there a limit to tax-loss harvesting. And if Marys capital losses exceed her capital gains for the year she can use up to 3000 of her net capital loss to offset ordinary income thereby reducing her income tax by 720 ie 3000 x.

However there are limits to the amount of taxes on ordinary income that can be offset. You can harvest losses to offset gains as well as up to 3000 in non-investment income. Tax-loss harvesting refers to selling an asset at a loss to offset the gains on the sale or sales of other investments.

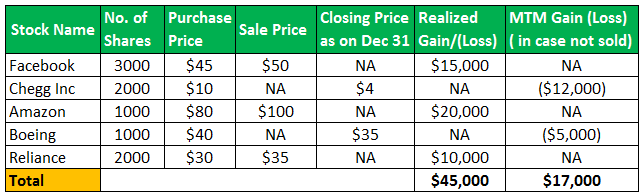

As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. According to the wash-sale rule when you harvest losses you cannot repurchase substantially identical investments for 30 days. Mary can use the 7000 capital loss to offset any capital gains she realized this year.

Now any long-term gain made from equity investments over and above Rs. So far tax loss harvesting sounds like a great way to reduce ones tax liability. As a married couple filing jointly or a single filer you can realize up to 3000 of capital losses to reduce your ordinary taxable income in a given year.

1 lakh in a financial year is taxable at 10. You need to complete all of your harvesting before the end of the calendar year Dec. Tax-loss harvesting can be used to offset 100 of capital gains for the year and up to 3000 of personal income.

Is There Any Limit to Tax Loss Harvesting. You can harvest as much as you want and offset up to 100 of your capital gains. So set that egg timer and get to work.

Assuming youre subject to a 35 marginal tax rate the overall tax benefit of harvesting those losses could be as much as 8050. TLH Annual Limit of 3000. The losses can offset 3000 of income on a joint tax return in one year.

Any net losses above this can be rolled over into future tax years. Under current law a capital loss deduction allows an investor to claim up to 3000 more in losses than in capital gains meaning investors can reduce their taxable income dollar for dollar up to that 3000 limit. However there is no such grace period for tax-loss harvesting.

They can usually also offset up to 3000 in other income. Any remaining losses after that will roll over to the next tax year. There is no limit to the amount of investment gains that can be offset with tax-loss harvesting.

First if the long term investor mentioned above who has no realized gains wants to harvest losses to reduce their taxable income they can only do so up to a limit of 3000 per year if single or married filing jointly. There is no limit on how much loss you can harvest. Tax-loss harvesting is very episodic when its there we look to take advantage.

The leftover 2000 loss could then be carried forward to offset income in future tax years. Any remaining amount can be used to deduct up to 3000 from your ordinary income to reduce income taxes. Life Yield Helps Advisors Meet the Challenges of Tax Harvesting.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Turning Losses Into Tax Advantages

Tax Loss Harvesting Everything You Should Know

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Turning Losses Into Tax Advantages

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

Reap The Benefits Of Tax Loss Harvesting

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management